Bank Fractional Routing Number

What is a Fractional Routing Number

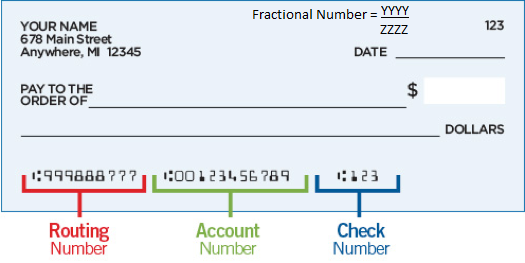

The fractional number goes like this: YYYY/ZZZZ.

YYYY is digits 5 to 8 of the nine digit routing number of Bank (the last, 9th digit, is control digit - ignore it). The numerator is Bank's ABA Institution Identifier

ZZZZ is the first 4 digits of Bank routing number (you can skip the leading zeroes).

The denominator is also part of the routing number; by adding leading

zeroes to make up four digits where necessary (e.g. 102 is written as

0102, 57 is written as 0057, etc.), it forms the first four digits of

the routing number (9998 in our example).

The Routing Number is also called an ABA number or routing

transit number.

How to create Bank Fractional Routing Number

Steps:

~ In our example the fractional number is 8877/9998

~ Use the table below to lookup Bank routing number

~ It's in the lower left-hand corner of your checks. Look for the 9 digit number between these symbols: 123456789

When mailed Checks, "Next-Day" or "Same-Day" payments are too slow - think Real-Time Bill Payments:

- Real-Time Online Bill Payments are SAFE: bank-to-bank transactions, using bank login authorization, are the most secure method of funds transfer available.

- Real-Time Online Bill Payments are FAST: 24/7/365 payments and access to funds anytime.

- Real-Time Online Bill Payments are EFFICIENT: The platform makes digital payments effortless and more efficient. We drive efficiencies and cost savings.

- Real-Time Online Bill Payments are EASY TO USE: It connects users across the globe all through one digital hub.

Fraud Protection: Identify, manage and prevent suspicious or potentially costly fraudulent transactions with our customizable, rules-based solutions.

Worried about Internet security? DON'T BE:

After a transaction is processed, you'll even receive an e-mail with amount confirmation and receiver information. Plus, our payment platform gives you the ability to manually key-in transactions anywhere there's an Internet connection.

Instant Real-time Bill Payments

Use your bank account with Bank

HIGHLY RECOMMENDED!

All U.S. companies / billers should enroll

-

Real-Time Invoicing

-

Biller / Merchant Enrollment

-

Real-Time Funding

-

Instant Notification to all parties

-

Accounting Software Integration

-

CRM Integration

-

Payment Choice: ACH, Card, Real-Time Payments and more!

What is: Real-Time Bill Pay?

Real-Time Bill Payments are offered through banks and credit unions to enable consumers to use their computer or mobile banking app to easily set up all billers, receive notifications on payments due, view billing details and manage multiple accounts in one place, while also allowing customers to specify when and how much to pay various accounts. Processing for both B2B & C2B ~Process with the Bill Pay Exchange Professionals

- Automation of Accounts Receivable Collection with Real-Time Settlement & Deposit

- Automation of Accounts Payable Payments with Real-Time Settlement & Deposit

- One-Time & Recurring Debits & Credits with Real-Time Settlement & Deposit

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Want to know more about Real-Time Bill payment processing?